Understanding Payment Rails | The Best Solutions for Your Business

In the ever-evolving world of business, staying ahead means embracing the latest technological advancements, especially when it comes to handling payments.

Payment rails are the lifeblood of financial transactions, providing the infrastructure that enables the seamless transfer of money between parties. Imagine payment rails as the tracks of a railroad system, allowing money to travel smoothly and efficiently from one account to another. Without them, the entire financial ecosystem would come to a standstill.

Understanding the various types of payment rails and their unique functionalities is crucial for businesses aiming to optimize their financial operations.

This comprehensive guide will delve into what payment rails are, explore different types, and help you determine the best options for your business.

Types of Payment Rails

1. Account-to-Account (A2A)

Account-to-Account payments, or A2A, involve the direct transfer of funds from one bank account to another. This method is especially popular in Europe, facilitated by open banking APIs that allow consumers to make payments directly from their bank accounts to third-party accounts.

Key Features:

Fast Settlements: Transactions are processed quickly, enhancing cash flow.

Low Fees: Avoid card fees, making it cost-effective.

Broad Coverage: Widely used across Europe, offering extensive reach.

2. SEPA

The Single Euro Payments Area (SEPA) simplifies euro transfers within participating European countries, making cross-border transactions as seamless as domestic ones.

Key Features:

SEPA Credit Transfer: Funds transfer within one business day.

SEPA Instant Credit Transfer: Near-instant transfers at any time of day.

SEPA Direct Debit Transfer: Ideal for recurring payments with pre-signed agreements.

3. SWIFT

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a global messaging network for international money transfers, providing a secure and standardized way to send payment instructions.

Key Features:

Global Reach: Used by banks worldwide for international transfers.

Standardized Codes: Unique SWIFT codes for each financial institution.

Secure Messaging: Ensures safe and reliable communication between banks.

4. Credit and Debit Card Networks

Credit and debit card networks, including Visa, Mastercard, Discover, and American Express, facilitate transactions between merchants and customers through their respective infrastructures.

Key Features:

Wide Acceptance: Universally accepted for consumer convenience.

Transaction Fees: Merchants pay fees for using these networks.

Delayed Settlements: Funds can take days to reach merchant accounts.

5. Digital Currency & Blockchain Networks

Digital currency payment rails operate on blockchain technology, enabling secure and transparent digital transactions without intermediaries like banks.

Key Features:

Blockchain Security: Immutable and transparent transaction records.

Lower Fees: Reduced transaction costs compared to traditional methods.

Global Accessibility: Cross-border payments without currency exchange issues.

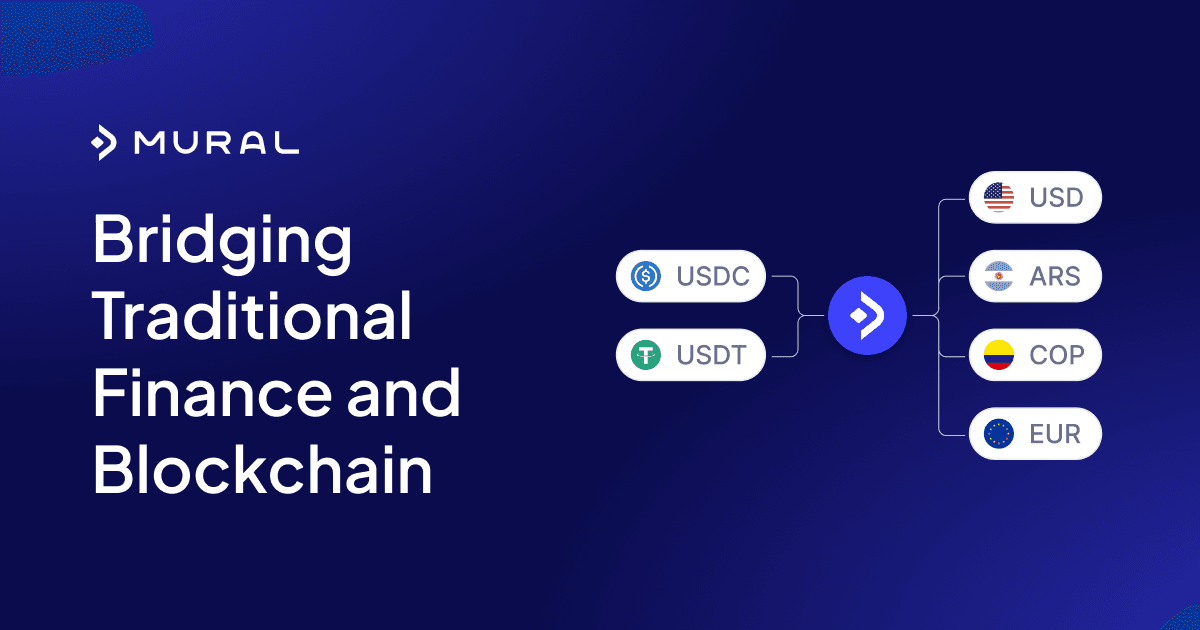

Mural offers fast and cheap global payments via the blockchain.

6. CHAPS

The Clearing House Automated Payment System (CHAPS) is a UK-based rail for high-value transactions, offering same-day settlements.

Key Features:

High-Value Transfers: Suitable for large financial transactions.

Same-Day Settlement: Quick and reliable for urgent payments.

No Monetary Limits: Ideal for significant business transactions.

7. Faster Payments

The Faster Payments Service (FPS) in the UK allows near-instant electronic transfers, providing a fast and efficient alternative to traditional methods.

Key Features:

24/7 Operation: Transactions processed anytime, including weekends and holidays.

Rapid Transfers: Payments settled within seconds to two hours.

Transaction Limits: Typically for payments under £1 million.

Why Are Payment Rails Important?

Payment rails are essential for facilitating financial transactions. They provide various benefits, including different settlement times and fees, enabling businesses to choose the most suitable option for their needs.

Key considerations include:

Speed of Settlement: Faster rails improve cash flow and customer satisfaction.

Technological Requirements: Compatibility with existing systems is crucial.

Cross-Border Transactions: Necessary for international business operations.

Security Measures: Different rails offer varying levels of security.

Cost Efficiency: Understanding fees associated with each rail helps in managing expenses.

Choosing the Right Payment Rails for Your Business

Selecting the appropriate payment rail involves evaluating your business’s specific needs.

Consider the following:

Settlement Speed: How quickly do you need transactions to settle?

Technological Compatibility: Does the payment rail integrate with your existing systems?

International Reach: Do you conduct cross-border transactions?

Security Measures: What level of security is provided?

Cost Efficiency: What are the associated fees?

Payment Rails at a Glance

Mural

Associated Fees: Low transaction fees

Security Measures: Top-notch security features, compliant with regulations

International Reach: Global

Tech Compatibility: Supports various payment rails (A2A, SEPA, SWIFT, Cryptocurrency)

Settlement Speed: Fast settlements, typically same-day

Account-to-Account (A2A)

Associated Fees: Generally low, avoids card fees

Security Measures: Secure with open banking APIs

International Reach: Europe

Tech Compatibility: Compatible with open banking APIs

Settlement Speed: Fast, usually within a business day

SEPA

Associated Fees: Same as domestic transaction fees

Security Measures: Standardized with IBAN and BIC, highly secure

International Reach: Europe and participating countries

Tech Compatibility: Requires IBAN and BIC

Settlement Speed: Credit transfer: 1 business day, Instant transfer: nearly immediate, Direct debit: recurring

SWIFT

Associated Fees: Percentage fee charged by banks

Security Measures: Uses unique SWIFT codes, very secure

International Reach: Global

Tech Compatibility: SWIFT codes required for transactions

Settlement Speed: Typically 1-5 business days

Credit and Debit Card Networks

Associated Fees: Merchant fees vary by network

Security Measures: Secure with multiple layers of authentication

International Reach: Global

Tech Compatibility: Widely accepted by POS systems and online gateways

Settlement Speed: Delayed, can take days to weeks

Blockchain Networks

Associated Fees: Generally lower than traditional methods

Security Measures: Blockchain technology ensures immutability and transparency

International Reach: Global

Tech Compatibility: Requires digital wallets and blockchain tech

Settlement Speed: Immediate to a few minutes

CHAPS

Associated Fees: Fixed fee per transaction

Security Measures: High-security, used for large-value transactions

International Reach: UK

Tech Compatibility: Bank account details needed

Settlement Speed: Same-day if instructions are given by cutoff time

Faster Payments (FPS)

Associated Fees: Generally low

Security Measures: Secure with real-time processing

International Reach: UK

Tech Compatibility: Compatible with online and mobile banking platforms

Settlement Speed: Within seconds to two hours

Fedwire

Associated Fees: Fixed fee per transaction

Security Measures: High-security, used for large-value and time-sensitive transactions

International Reach: US

Tech Compatibility: Requires bank account details

Settlement Speed: Real-time, typically within minutes

Interac

Associated Fees: Low transaction fees

Security Measures: Secure with encrypted data transfer

International Reach: Canada

Tech Compatibility: Compatible with online and mobile banking platforms

Settlement Speed: Immediate for e-Transfers, same-day for Debit payments

RTP (Real-Time Payments)

Associated Fees: Low transaction fees

Security Measures: Secure with immediate validation and settlement

International Reach: US

Tech Compatibility: Requires bank account details

Settlement Speed: Immediate

How Mural Provides the Best Payment Rail Solution

Mural offers an advanced platform designed to streamline global business payments.

Here’s why Mural stands out:

Low Transaction Fees: Mural offers competitively low transaction fees, making it cost-effective for businesses.

Robust Security: Mural's system is designed with top-notch security features, ensuring compliance with financial regulations and protecting against fraud.

Global Reach: Mural supports a variety of payment rails, enabling seamless international transactions.

Tech Compatibility: Mural integrates with multiple payment systems, including A2A, SEPA, SWIFT, and blockchain networks, providing flexibility and ease of use.

Fast Settlements: Mural ensures quick settlement times, typically processing transactions within the same day, which enhances cash flow and operational efficiency.

Diverse Payment Options: Mural supports a variety of currencies, including digital currencies such as USDC and USDT.

User-Friendly Interface: Mural’s intuitive platform makes managing payments simple and efficient.

Who Is Mural For?

Mural is ideal for businesses of all sizes that need a reliable, efficient, and cost-effective payment solution. Whether you’re a freelancer, a digital nomad, small business, or a large enterprise, Mural can help streamline your payment processes and improve your financial operations.

Mural is especially useful for individuals and businesses in emerging economies where local currencies can often be unstable, and local financial institutions unreliable.

Conclusion

Payment rails are the backbone of modern financial transactions, enabling businesses to operate smoothly in a global economy. Understanding the various types of payment rails and their unique features is crucial for optimizing financial operations and meeting customer expectations. As businesses continue to evolve, leveraging the right payment rail solutions becomes increasingly important.

Mural stands out by offering a comprehensive suite of payment solutions that cater to diverse business needs. With Mural, businesses can enjoy faster settlements, lower fees, robust security, and a user-friendly interface, making it the ideal choice for efficient and cost-effective payment processing.

Embrace the future of payments with Mural and transform your business’s financial operations. Learn more about how Mural can benefit your business by booking a demo today.