How International Payroll Services Are Transforming the Gig Economy

The gig economy, a phenomenon widely popularized through social media and digital platforms such as UBER and UpWork, has redefined the traditional employment landscape.

Characterized by short-term, flexible jobs often facilitated by digital platforms, the gig economy has fundamentally altered the traditional employment landscape.

From freelance writers and graphic designers to ride-share drivers and delivery couriers, an increasing number of workers are opting for gig-based roles over traditional 9-to-5 jobs. This shift is driven by various factors, including the desire for flexible working hours, the opportunity to earn supplemental income, and the advancements in technology that make remote work more feasible than ever.

Top Gig Economy Platforms and What They Pay

Platform Average Rate ($/hour):

Uber: $15-$25

Lyft: $15-$25

DoorDash: $10-$20

Upwork: $15-$45

Fiverr: $5-$30

TaskRabbit: $15-$40

Instacart: $10-$20

Postmates: $12-$20

Freelancer: $10-$40

These rates can vary significantly based on factors such as location, experience, task complexity, and demand.

However, as the gig economy continues to expand, it brings with it a unique set of challenges, particularly in the realm of payroll management.

Traditional payroll systems, designed for stable, long-term employment, struggle to keep pace with the dynamic and often unpredictable nature of gig work. Businesses must navigate a complex web of payment structures, tax regulations, and compliance requirements, which vary not only from country to country but often from one gig worker to another.

Enter international payroll services, a game-changer in the world of gig work.

These services offer sophisticated, cloud-based solutions that are specifically tailored to handle the intricacies of the gig economy. By automating payroll processes, ensuring compliance across multiple jurisdictions, and providing flexible payment options, international payroll services are transforming how businesses manage their gig workforce.

Preparing for the Future of Payroll

Businesses need to be proactive in embracing technological advancements to stay competitive.

Here are some key trends and strategies for future-proofing payroll systems:

1. AI and Automation

Artificial intelligence and machine learning are automating repetitive tasks such as data entry, compliance checks, and forecasting future requirements. This frees up valuable time for HR professionals to focus on strategic initiatives.

2. Integrated Payroll Systems

Integrated payroll systems that connect HR, time tracking, and financial management are becoming essential. This connected approach streamlines operations and provides comprehensive insights into workforce management.

3. Real-Time Analytics

Advanced analytics capabilities unlock real-time insights into workforce trends, labor costs, and employee engagement. This empowers businesses to proactively manage their workforce and improve decision-making.

4. Financial Wellness Programs

Payroll systems are integrating with financial wellness programs, offering money-saving tips, budgeting tools, and personalized advice, which enhance employee satisfaction and retention.

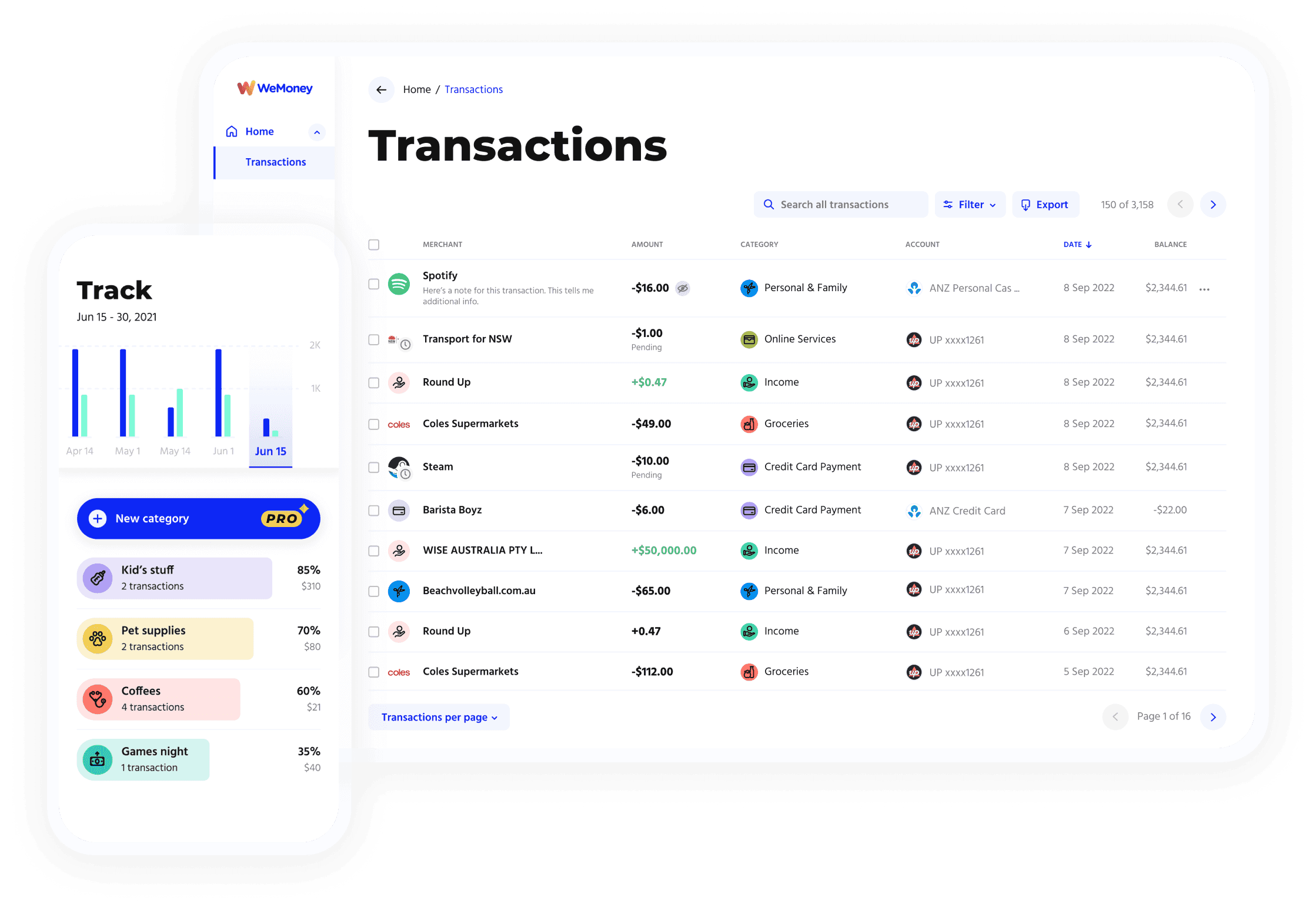

Apps like WeMoney help people measure and manage their financial wellness.

5. Robust Cybersecurity

With increasing cyber threats, robust data security measures are crucial. Secure cloud-based payroll software, encrypted data storage, and multi-factor authentication protect sensitive payroll information.

6. Mobile-First Experience

Mobile apps enable employees to access their paystubs, select benefits, and track hours from their smartphones, making payroll processes more convenient and efficient.

7. Global Expansion Capabilities

Modern payroll systems support global operations, handling employee pay across different countries while ensuring compliance with local tax laws.

8. Emerging Technologies

Technologies like biometrics and blockchain promise to enhance security and transparency in payroll processes, paving the way for more secure and efficient systems.

Embrace Future-Proof Payroll Solutions

Gig work, characterized by flexible schedules and diverse income sources, demands a payroll system that is both agile and precise. Traditional payroll methods often falter under these dynamic conditions.

By staying informed about the latest payroll trends and technologies, businesses can navigate the changing world of work with ease.

A seamless, efficient, and secure payroll experience not only keeps employees happy but also boosts overall productivity and profitability. The gig economy offers a wealth of opportunities, and with the right payroll solutions, businesses can fully capitalize on this dynamic workforce landscape.

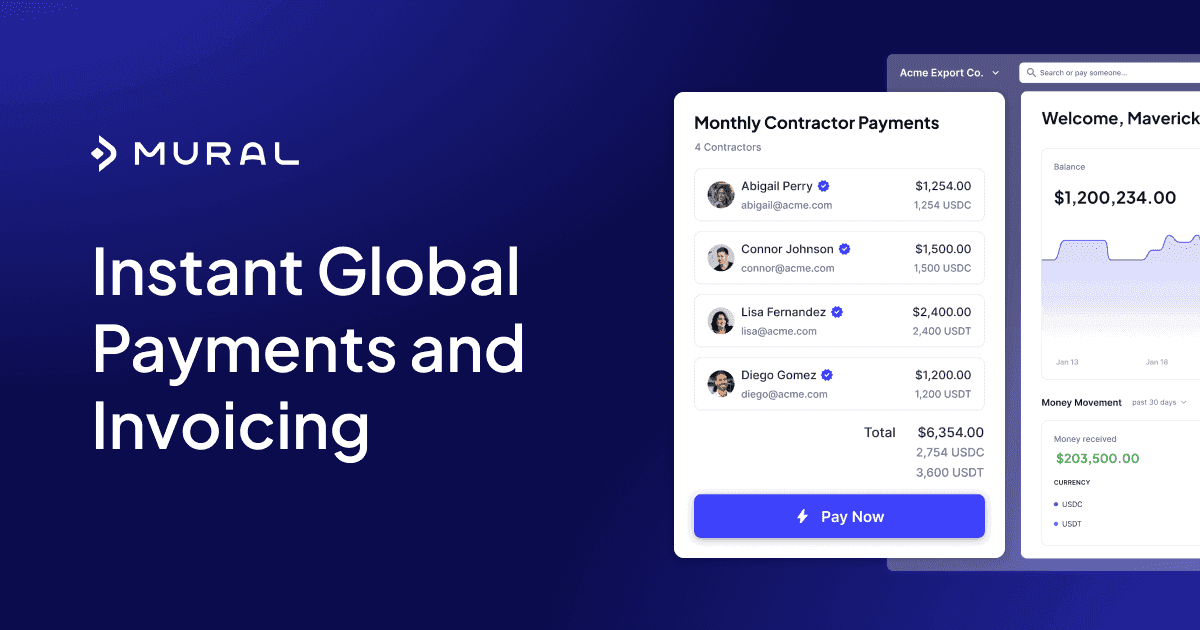

Revolutionizing Payroll Management with Mural

Mural is more than just a tool; it's an empowerment. It enables businesses to effectively eliminate the obstacles tied to managing their own payroll. This simplification is crucial in the gig economy, where the workforce is as varied as the tasks they undertake. By providing a centralized and streamlined payroll management system, businesses can focus more on their core operations and less on administrative burdens.

A Future-Forward Approach

Mural’s system is a testament to the future of payroll management. In a world where work patterns are continuously evolving, having a system that adapts and grows with your business needs is not just beneficial; it's essential. The gig economy is expanding rapidly, and businesses must stay ahead by leveraging advanced payroll technologies.

Automating for Accuracy and Ease

Automation is at the forefront of modern payroll systems. Mural’s solution smartly calculates employee payments, ensuring accuracy and reducing the manual burden. This feature is invaluable in the gig economy, where payment structures vary widely from one worker to another. By automating payroll processes, businesses can minimize errors and ensure timely payments, enhancing worker satisfaction and retention.

Streamlining Compliance and Filings

Staying compliant with tax laws and employment regulations is a significant challenge, especially when these vary across regions. Mural’s system simplifies this maze, ensuring businesses adhere to the latest legal standards with ease. Payday filings and tax payments become streamlined processes, saving time and reducing errors. This compliance ease is crucial for businesses operating in multiple jurisdictions, as it mitigates the risk of legal penalties and fines.

Conclusion

Looking ahead, the role of international payroll services in the gig economy is poised to become even more critical. As remote work continues to rise and the global workforce becomes increasingly interconnected, businesses will need payroll solutions that are adaptable and scalable.

By embracing tools like Mural, businesses can not only navigate the complexities of the gig economy with ease but also unlock new opportunities for growth and efficiency.

The future of payroll lies in automation, real-time analytics, and robust compliance capabilities, all of which are essential for thriving in the dynamic and ever-changing gig economy landscape.

As the gig economy continues to expand, the importance of reliable, flexible, and comprehensive payroll systems cannot be overstated. Businesses that invest in these advanced solutions will be well-positioned to attract and retain top talent, ensure compliance, and achieve operational excellence.

In this new era of work, international payroll services are not just a necessity; they are a strategic advantage that can propel businesses towards greater success in the global marketplace. Embracing these innovations today will pave the way for a more efficient, profitable, and resilient future.

Imagine a world where payroll complexities are a thing of the past, where the challenges of the gig economy are met with smart, efficient solutions. This is the reality Mural offers.

By revolutionizing your payroll, it creates a more efficient, profitable environment for your organization.

The familiar landscape of payroll, with its paper trails and time-consuming calculations, is rapidly fading into the past.