Digital Dollars: The Future of Instant Global Payments

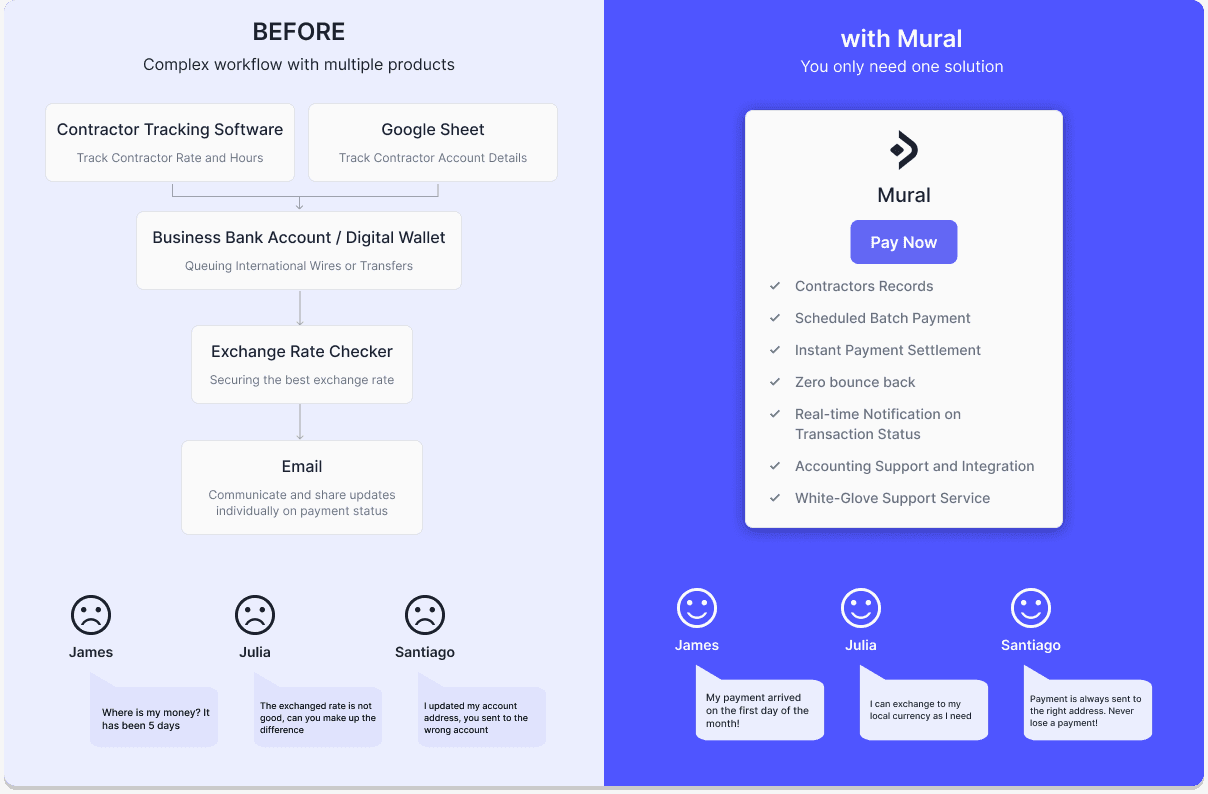

In an era where workforces are increasingly global, and teams are not confined to a single office location, the ability to conduct seamless financial transactions across borders becomes essential. More than ever, companies require practical global payment tools to manage diverse teams and complex economic interactions. Mural is designed to meet this need, offering instant global payment capabilities and ensuring that businesses can keep pace with the changing landscape of international team management.

By using digital dollars like USDC, teams can guarantee instant payouts with no delays at a fraction of the cost. This innovative technology enables companies to bypass traditional banking delays and facilitates a more fluid movement of funds internationally. Digital dollars are rapidly becoming a global cornerstone for companies, simplifying financial transactions securely and efficiently.

In this blog, we will explore how businesses in varying sectors harness this technology through Mural's platform. From a software development agency in Latin America to a global digital marketing firm and an accounting firm with a worldwide clientele, each scenario will provide a glimpse into the impact of embracing digital dollars into their operations. We'll explore the specific features of Mural that facilitate these changes, demonstrating the practical benefits and operational efficiencies gained from adopting instant global payments.

Embracing Efficiency: A Latin American Tech Firm's Journey

Consider a software development agency in Latin America grappling with the challenges of streamlining contractor payments. Traditionally, such agencies may have turned to third-party platforms and international wires, only to be met with high fees and subscription costs. These financial burdens, along with payment delays and a lack of transparency, often compromise the trust and satisfaction of their contractors.

Mural's user-friendly platform facilitates a smooth transition to digital dollars, enabling instant payouts globally, enhancing the payment process, and fostering transparency & trust among the workforce.

Instead of paying thousands in international wire transfers at the end of the month and worrying about making up the losses due to currency conversion, Mural enabled this agency to effortlessly deposit their USD as digital dollars, and directly pay out all their contractors in a matter of seconds. Not only are there decreased transaction fees, but the hassle of dealing with currency exchanges and lost funds is completely removed. The agency was also able to use the batch payment feature to pay out multiple people at once. The result was the delivery of instant global payments to contractors, complete with transparency. By doing so, the agency not only fortified its trust in its workforce but also significantly reduced its operational overhead, marking a new chapter of efficiency and satisfaction in its financial dealings.

Optimizing Cash Flow: A Global Digital Marketing Agency's Strategy

Imagine a global digital marketing agency with a clientele that prefers transacting in USDC for its borderless and instant transaction capabilities. While digital currency payments align with the agency's innovative approach, they also present a need for meticulous cash flow management to ensure operational liquidity and simplified accounting practices.

Mural's Withdrawal feature provides the agency with the flexibility to convert their USDC earnings into USD whenever necessary. This capability is crucial for maintaining a steady cash flow, particularly when needing to cover overhead costs, pay local vendors, or manage other expenses typically incurred in fiat currency. The process is streamlined: with a few clicks, the agency can move their funds from digital to traditional banking systems, ensuring they have the right form of currency at the right time, without unnecessary delays or transaction fees. This efficient system not only optimizes their financial operations but also provides clarity and ease in their financial reporting and reconciliation processes.

Streamlining Operations: An Accounting Firm's Digital Integration

Consider an accounting firm that has embraced the digital age by invoicing clients in USDC, catering to a global clientele who value the immediacy and innovation of blockchain payments. This firm faces the dual challenge of managing incoming digital funds and disbursing payments to its contractors scattered across different countries.

By leveraging Mural's Deposit feature, the firm can effortlessly top up their Mural account to ensure that payroll funds are always ready for disbursement. Conversely, when the firm finds itself with an excess of digital dollars, Mural's Withdrawal feature comes into play, allowing for the swift conversion of USDC back to USD, maintaining a balanced ledger and ensuring funds are available in the currency they need when they need it.

This dual-feature approach positions Mural as a comprehensive financial partner for the firm, streamlining the entire payment lifecycle. From stablecoin invoicing to executing contractor payments, the firm benefits from Mural's seamless integration, reducing the complexity of managing multiple currency forms and enhancing overall financial efficiency.

The Future of Finance with Digital Dollars

The transformative power of digital dollars in streamlining instant global payments is evident across diverse business landscapes. As demonstrated, whether it’s a software development agency optimizing contractor payouts, a marketing firm managing international cash flow, or an accounting firm consolidating their financial operations, the adoption of digital dollars through Mural's platform significantly enhances efficiency, reduces costs, and strengthens trust.

We invite businesses of all sizes to consider the strategic advantages of Mural’s financial ecosystem. Explore how our platform can simplify and elevate your financial operations. Take the next step towards fiscal innovation — book a demo with Mural today and experience the full potential of digital dollars in action.